Economic returns for infrastructure investments in developing countries are not promising

The question is how to invest when the published evidence to date suggests that ex post investment returns in foreign assistance countries are lower than ex ante investment returns (Yasin, 2003, Rajan and Subramanian, 2005, Easterly, 2007, Roodman, 2007, Deaton, 2013, Easterly, 2014, Warner, 2014). One study has reviewed 106 papers with over 1,217 estimates of growth based foreign assistance1and found “aid is positive but of no economic significance…with decades of research suggesting that aggregate development aid flows are ineffective at generating growth.” (Doucouliagos and Paldam, 2010). The lesson to draw from this is that foreign aid requires a stringent economic evaluation framework within which projects are developed and implemented to help ensure economic impact. One of the interesting metrics presented is related to Overseas Development Assistance (ODA) and its effect on growth ; the Nobel economist Angus Deaton has noted that countries like China, India and South Africa have prospered with a tenth of the amount of ODA as a percentage of national income, relative to 36 SSA countries with at least 10% or more, with some of these countries’ budgets made up of up to 75% of ODA (Deaton, 2013). In other words, countries that received less development assistance seem to have done better than those that have received more development assistance. Considering an estimated $4.6 trillion have been spent to date (Easterly and Williamson, 2011) on overseas development assistance with an estimated 36 to 40% of it devoted to technical assistance mostly provided by expatriates (Riddell, 2008), there is an urgent need to improve performance efficiency if one is to meet the challenge of funding more infrastructure going forward to promote economic growth while truly transferring technical assistance and knowhow to these countries.

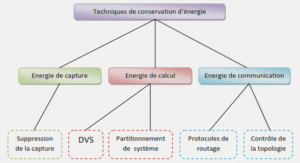

Poor understanding/practice of pavement asset management fundamentals The planning phase and the implementation phase both suffer from the same fundamental issues, notably the mismatch between pavement asset management fundamentals and local/donor capacity/willingness to understand and absorb these fundamentals in a locally appropriate manner with a focus on performance. In order to prioritize network level investments (and their returns), one needs a solid pavement asset management system in place that responds to the technical capacity levels of the road agency, not the latest fads and most recent technological advances, which is where a lot of emphasis is placed by donor agencies (Wood and Metschies, 2006, Asian Development Bank, 2013). Figure 1.5 below illustrates the general spectrum of complexity of a Pavement Management System, however this does not account for the time it takes to build the institutional and educational awareness to progress from database development to the application of engineering logic and economics to simulate risk management models.

Political decision making and limited investment transparency and accountability Robinson and Torvik (2005) have indicated that there are incentives for key stakeholders to misrepresent the costs and benefits of a project in order to secure funding. Robinson and Torvik have demonstrated that “white elephant projects” are politically attractive in order to influence voters who would otherwise not find them politically appealing; the argument is that socially efficient projects do not allow politicians a way to differentiate themselves from others; white elephants provide some politicians the ability to credibly promise some sort of redistribution to supporters as long as the political benefits are larger relative to the socially efficient projects’ surplus (Robinson and Torvik, 2005). The road agency, as an extension of the state or on its own volition, is incentivized to promote these projects, especially to donors that are not necessarily politically aware of what is occurring. Reviewing donor performance in the road sector is difficult. The 2016 Aid Transparency Index performed by the International Aid Transparency Initiative found that only 25% of international aid donations are fully transparent (Sharman, 2016), which is also supported by development literature. (Riddell, 2008)

One primary issue is that donor agencies’ primary beneficiaries provide minimal feedback (if any at all) and much less in a timely manner (Williamson, 2009) to affect donor behavior. Donor agencies typically rely on some sort of government agency to communicate the needs of the actual beneficiaries, which allows the host government to control the central messaging around the issue vis-a-vis the donor. This reliance on host government agents can be conflicting, especially in the case of state capture and/or corruption. As such, it is essential that any donor agency provide extensive diligence in checking and verifying the reliability of all data at all stages of the project lifecycle to ensure the viability of the investment, and also take appropriate measures to independently review all designs, tender preparation, procurement and execution so that quality, budgets, schedules and benefits are met.

There appears to be a consistent problem across donor agencies with access to high quality, timely and accurate data to make an informed investment decision. Data is hard to collect and the reliability of the data is not always promising. The results show that most donor agencies spend a large degree of time outsourcing the data collection and analysis without always fully verifying the resulting data quality, which leads to less than optimal outcomes in the field (Warner, 2010, GAO, 2012a, GAO, 2012b, Warner, 2014, Rose and Wiebe 2015). This finding suggests that an extensive, yet cost effective, data collection and verification approach is required; or to quote former U.S. President Ronald Reagan “trust, but verify.” Riddell argues that donors as a whole are more incentivized to show the short-term effects of aid working (number of people helped or served) as opposed to the extent to which they achieved the standards in aid delivery they pledged to meet. (Riddell, 2008) Verification of the investment decision calculations, both ex post and ex ante, are not possible, with some notable exceptions, as the full data sets are rarely provided to the public for review (Rose and Wiebe, 2015, Pritchett, 2002). The MCC model helps counter this problem with extensive postcompact assessments and data transparency requirements.

A thorough review of many economic assessments of road projects performed by numerous consultants in various developing countries show that the determinant assumptions used in the ERR calculations are not always provided, justified, documented or sourced. One performance metric that donor agencies do use routinely is the level of disbursements relative to the planned or stated goal targets. Williamson notes that this is a rational bureaucratic outcome that is driven by the need to maintain or grow the donor agency budget (Williamson, 2009). Agencies that provide grants are incentivized to obligate funding to a certain country in a certain year to demonstrate the need for full or increased agency funding for future years (Rose and Wiebe, 2015). Agencies that provide loans are incentivized to make loans, which provide interest revenue for the agencies, regardless of investment decision criteria like a cost benefit analysis.(Klein and Harford, 2005) At the end of the day, donor agencies’ ultimate decisions come down to their ability to spend the allotted money in each fiscal period to meet the agency needs; the problem is that they do not always know where the best investments are in each country. The primary takeaway is that donor agencies need a tool that helps them quickly identify the winner projects early-on to ensure sufficient financial and economic viability, but also provide a sufficient pool of high-quality investments that can adjust based on agency needs; Chapter 3 of this thesis provides one such mechanism.

|

Table des matières

INTRODUCTION

CHAPTER 1 LITERATURE REVIEW, JUSTIFICATION AND SCOPE OF RESEARCH

Literature review

1.1.1 The promise of economic returns from infrastructure investment

1.1.2 Economic returns for infrastructure investments in developing countries are not promising

1.1.3.1 Poor understanding/practice of pavement asset management fundamentals

1.1.3.2 Political decision making and limited investment transparency and accountability

1.1.4 Misaligned incentives

1.1.5 Isomorphic mimicry and premature loading

1.1.6 Corruption eats away at economic benefits

Justification and scope of research

1.2.1 Part I – Fast-track network level analysis

1.2.2 Part II – Technical optimization

1.2.3 Part III – Graphical data representation dashboard

CHAPTER 2 RESEARCH OBJECTIVES AND METHODOLOGY

Research objectives

Research methodology

2.2.1 Network level prioritization model

2.2.2 Project level design technical optimization

2.2.3 bayesian model to determine the most likely cause of deterioration

CHAPTER 3 FAST TRACK NETWORK LEVEL PRIORITIZATION MODEL

3.2.1 Annual IRI deterioration

3.2.2 Collection of IRI data

Capital and maintenance costs

Traffic

3.4.1 Annual traffic growth rate

3.4.2 Annual average daily traffic (AADT)

Validation of the err MS Excel-based model

CHAPTER 4 USING ITINERARY DIAGRAMS AND STATISTICAL ANALYSIS TO DETERMINE THE CAUSE OF DETERIORATION TO PROVIDE AN OPTIMAL ENGINEERING DESIGN SOLUTION

Data management, analysis and the concept of itinerary diagrams

Pavement engineering fundamentals for the itinerary diagrams

Data needs for the itinerary diagrams

4.3.1 Traffic volume and loading levels assessment

4.3.2 Structural assessment

4.3.3 Road condition assessment

4.3.4 Road widening needs assessment

4.3.5 High-resolution imagery

4.3.6 Integration of environmental and resettlement aspects

Determining the causes of deterioration

4.4.1 type i: structural deterioration (traffic based)

4.4.2 Type II: Materials deterioration (water and environment)

4.4.3 Type III: Thermal deterioration (water, temperature and fines)

4.4.4 Type IV: Mix design and placement deterioration (bitumen and aggregates)

Identification of the most likely causes of deterioration through Bayesian modeling

CHAPTER 5 VALIDATION OF THE ITINERARY DIAGRAMS CONCEPT IN DETERMINING THE CAUSE OF DETERIORATION

Use of the itinerary diagram to determine the cause of deterioration post construction

Use of the itinerary diagram to determine the cause of deterioration during project assessment

CONCLUSIONS AND RECOMMENDATIONS

ANNEX I MS EXCEL PROGRAM

ANNEX II ANNEX II : BAYESIAN MATIX

LIST OF BIBLIOGRAPHICAL REFERENCES

![]() Télécharger le rapport complet

Télécharger le rapport complet